| NSPM in English | |||

Dissonance between macroeconomic policy and developmental interests of export-oriented sectors in Serbia |

|

|

|

| понедељак, 09. август 2010. | |

|

Сажетак: Искуства бивших неразвијених земаља као и успешних транзиционих привреда говоре да је развој снажног и конкурентног извозно-оријентисаног сектора кључни корак у постизању циља одрживог привредног развоја. Међутим, у супротности са њиховим искуствима, српска макроекономска политика са једне стране у потпуности занемарује интересе извозно-оријентисаног сектора, док са друге, фаворизује динамичан развој неразменског сектора и шпекулативних активности. У нашем раду стојимо на становишту да је српски модел развоја неодржив и штетан. Српској економској политици су потребне тектонске промене како би се сачувало оно што је преостало од националног богатства и, евентуално, изградила извозно-оријентисана производња чији је циљ генерисање одрживог фискалног и трговинског суфицита. Кључне речи: извозно-оријентисани сектори, неразменски сектори, јавни трошкови, дефицит текућег рачуна, девизни курс. Dissonance between macroeconomic policy and developmental interests of export-oriented sectors in Serbia*

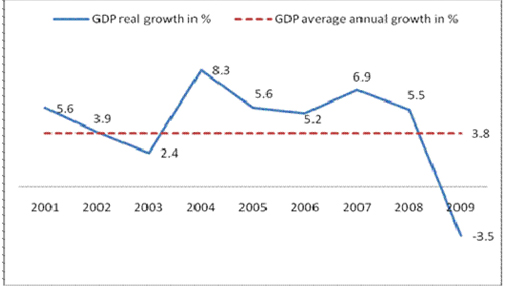

Key words: export-oriented sectors, non-tradable sectors, government expenditures, current account deficit, foreign exchange rate. "We must not let our rulers load us with perpetual debt." Thomas Jefferson Introduction Main task of any economic authorities should be to establish economic structure capable of generating a sustainable economic growth. Sustainable economic growth is by definition economic development that leads to fulfilling current needs, without jeopardizing future consumption of younger generations. In order to achieve this task in the long run, it is necessary to create a system that produces more than it consumes. In other words, it is of utmost importance to create a combination of trade, industrial, fiscal and monetary policies aiming at stabilizing prices and generation of trade and fiscal surpluses. Key of success lies in implementation of developmental policies that result in creation of strong and competitive export-oriented (tradable) sectors. Unfortunately, for the time being, Serbian authorities failed to achieve macroeconomic stability and, in general, to provide fertile macroeconomic environment for tradable sectors development. Namely, in last six decades Serbia had two economic regimes: socialistic (bureaucratic and self-management in period from 1945 to 2000) and capitalistic (from 2000 till today). In both regimes, the state was a key actor, and the final outcome has been a continual accumulation of systematic deficit and usage of different mechanisms in order to temporary cover deficit or to transfer this deficit into future at the expense of the forthcoming, not even yet born, generations. Result of Serbian economic paradigm has been creation of imbalances in almost all key social and economic sectors: imbalance between production and consumption, domestic accumulation and required level of investments, imports and exports, fixed and working capital in enterprises, employed and unemployed, employed in industry and employed in economic and state administration, center and periphery, etc. The main characteristic of the whole period of socialistic economy (1945-2000) was an imbalance between desired rate of economic growth and pace of accumulation of domestic savings, i.e. inability to finance, from domestic accumulation, the whole specter of built-in rights of different social groups. In addition to insufficient accumulation, this system produced suboptimal allocation of savings, thus multiplying already existing imbalances. From the beginning of communist ruling, normal, and to healthy mind logical paradigm savings – investments - increase in wealth clashed with insufficient domestic savings. This clash, was, of course, consequence of the fact that strategic problem of the Serbian society was invalidity of model of accumulation, which was based on the state and collective ownership. Unsuccessful quest for a rational model of accumulation, in which many different variations had been tested[1], is the main trait of the whole post World War II period. In the midst of fundamental lack of “capability” to create sufficient level of accumulation and to provide its rational allocation, the state became a key economic actor (ruling party nomenclature). Again, the state wasted its all energy in idle attempts to find perpetuum mobile mechanism aiming at continual covering of ever rising deficits at the individual level, and after, at the level of enterprises and finally at the level of the state (escalation of external illiquidity). This economic model, based on unstable and insecure sources of accumulation permanently caused instability and cyclical crises and, finally, breakdown of the system in 2000. In 2000, the Serbian society, seemingly, voted for elimination of a half- century long soft budget constraint and building up of a modern market economy grounded on the sustainable economic growth model. It supposed to be the end of the state, as a predominant economic actor. Building up the market and market institutions, passing and implementing laws that stimulate economic activity and uncompromisingly protect private ownership and business contracts, merciless war against corruption, investments in education, science, imports of modern technologies and expansion of tradable sectors, as well as increase in domestic savings were, in the first place, seen as effective remedies against almost a six-decade long disease of continual deficit accumulation. However, although in the course of last nine years, one could, on daily basis, read in newspapers and hear in the news bold announcements of Serbian officials about dynamic and sustainable economic growth of our economy, we argue in this paper that old matrix of economic functioning has not been changed yet: we consume more than we produce, our external debt has been increasing continuously, while export-oriented sectors have remained uncompetitive and underdeveloped. Reasons for growing difficulties we have been facing lie in lack of strategic approach to the issue of economic development, overly expansive fiscal policy, inconsistent monetary policy and political factors that promote dynamic development of non-tradable sectors and speculative activities. Economic growth and government expenditures In order to understand whether economic growth is sustainable, sources of this growth should be explored in more details. Economic growth is sustainable only if it is based on expansion of exports and, at the same time, steady and decreasing external debt and, on average, continuous generation of trade and current account surpluses. On the other hand, expansion of exports, and consequently, rise in competitiveness of local producers critically depends on macroeconomic stability. In other words, factors that strongly influence competitiveness of domestic producers are fiscal policy, monetary policy, development of infrastructure, education and science, rule of law and law enforcement, level of corruption, etc. Therefore, it is in this light recommendable to analyze quality of the economic growth of Serbia in the period of 2001-2009, in order to gain as accurate as possible estimation of its long-term sustainability. In the period of 2001-08 pace of growth of real Gross Domestic Product (GDP) of 6,7% annually was very high and promising. However, due to negative growth rate of GDP in 2009, as a result of the global financial crisis and, consequently, overall decrease in production of goods and services, as well as consumption, this imposing growth fell to modest 3,8% annually for the period of 2001-09 (Graph 1). Graph 1. Real and average annual growth of GDP

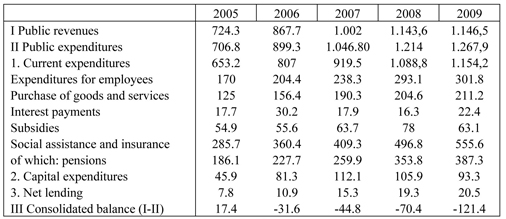

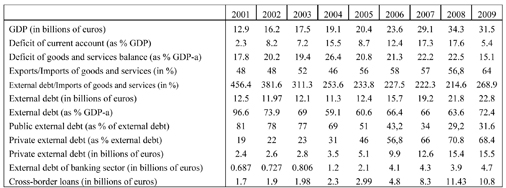

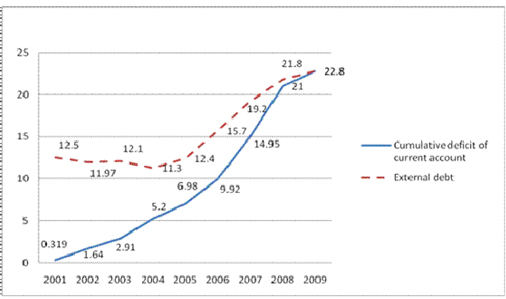

There are two main sources of this dynamic growth: high and expansive public spending and high consumption of household sector (Tables 1 and 3).[2] Since public spending grew faster than GDP, and because this spending was predominantly used for increase in final consumption, strong inflation pressures were created, and consequently, due to, among other things, increase in a real foreign exchange rate (Graph 3)[3] deficit of current account and trade balance was growing continually, which, in the final instance, led to increase in external debt (Table 2, Graph 2). On the other hand, again, when monetary authorities only partially sterilized[4] capital inflows, increase in external debt resulted in rise in money supply, which led to another round of rising inflation pressures, increase in real exchange rate and further deterioration in trade and current account deficit. Table 1. Consolidated balance of government, 2005-2009. (in billion dinars)

Source: Ministry of Finance, Republic of Serbia. Table 2. GDP, current account deficit, deficit of goods and services balance and external debt

Graph 2. Cumulative deficit of current account and external debt (in billions of euros)

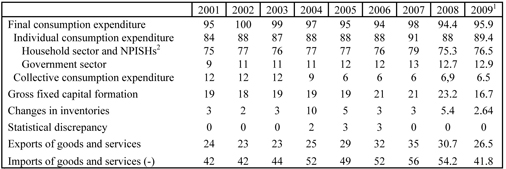

Source: Author’s calculations. If we pay a close attention to the use of GDP (Table 3) we will clearly see that, for example, in 2008 and 2009, share of household consumption expenditure in GDP was 75.3% and 76.5% and share of final consumption expenditure (sum of household and government expenditure) in GDP was 94.5% and 95.9% respectively.[5] Equally important, sum of final consumption expenditure and gross fixed capital formation (gross capital investments) exceeded GDP in 2008 and 2009 by 23% and 12.6% respectively, leading to conclusion that excessive consumption was financed by rise in external debt and privatization incomes. Additionally, having in mind that Serbia does not posses numerous and qualitative enough production capacities significant gap between consumption and production that has been filling with high and growing imports, would have been sustainable if most of the expenditures had been directed towards gross capital investments and inventories, i.e. if we had mainly imported machines and equipment that would have in, later stages of development, generated export incomes. However, gross capital investments have been, in comparison with similar countries in region, insufficient.[6] Share of consumption goods and oil and fuels in imports have been dominant in whole period after 2000. Consequently, share of imports in GDP has been almost twice as much as share of exports (Table 2). Table 3. The use of GDP

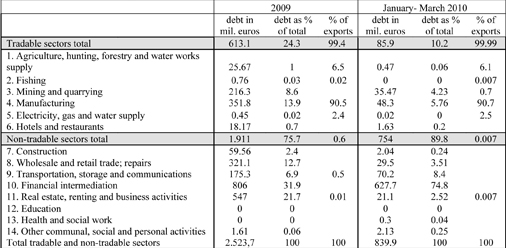

1 Estimation 2 Non-profit institutional units serving households Sources: Communication No. 67 (National accounts statistics) March 2010, Statistical Office of Republic of Serbia and IMF International financial statistics online. Rise of non-tradable and decline of export-oriented sectors Furthermore, not only investments in capital funds have been insufficient, but also its structure has been unfavorable. Concept of development, by which 80% of the sum of foreign credit debt and foreign direct investments has been directed towards non-tradable sectors, does not promise highly needed development of export-oriented production (Table 4). Table 4. Private sector’s long-term foreign credit debt by classification of activities and share of tradable and non-tradable sectors in exports in 2009

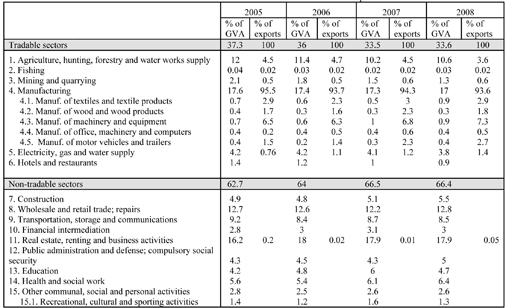

Source: Analysis of Serbian Foreign Debt, National Bank of Serbia, March 2010. Interestingly enough, share of non-tradable sectors in Gross Value Added (GVA= GDP minus taxes plus subventions) has been around 60% (Table 5). Table 5. Share of tradable and non-tradable sectors in Gross Value Added and exports

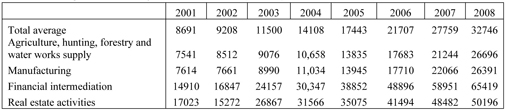

Sources: Statistical Yearbook 2006 and 2009, Communication No. 67 (National accounts statistics) March 2010, Statistical Office of Republic of Serbia and author’s calculation. Primary causes of dynamic growth of non-tradable sectors have been overly expansive fiscal and covertly expansive monetary policy, which resulted in a significant increase in domestic demand.[8] Consistently, part of this increase has been directed towards non-tradable, and the other part towards tradable sectors. However, due to lack of international competition, as well as notable monopolization and oligopolization of this sectors (control over prices), this increase in demand has had stronger effects on non-tradable sectors. Consequent rise in prices of non-tradable products and services, have made these sectors very attractive investment destinations.[9] On the other hand, increase in demand for products of tradable sectors has been divided between domestic and foreign producers (imports). Partial increase in demand for foreign products further unfavorably influenced trade balance and current account. Additionally, due to a strong inflow of foreign capital, salaries in non-tradable sectors grew faster than labor productivity, which consequently created strong inflation pressures. At the same time, due to the above mentioned lack of international competition, producers in non-tradable sectors have been in position to transfer this increase in costs (rise in salaries) to buyers through generally higher price level. Also, having in mind that producers from tradable sectors are big consumers of non-tradable outputs, this rise in non-tradable prices increased unit costs of export-oriented enterprises, which further deteriorated their competitiveness in international markets. Furthermore, due to strong emulation effect, rise in real salaries in non-tradable sectors and struggle for qualitative labor force put additional upward pressure on tradable sector’s production costs (Table 6). Therefore, export-oriented producers were forced either to rise salaries of their employees, which further deteriorated their financial condition, or to face losing the best educated and most productive personnel. Table 6. Average net salaries by fields of activities (in RSD)

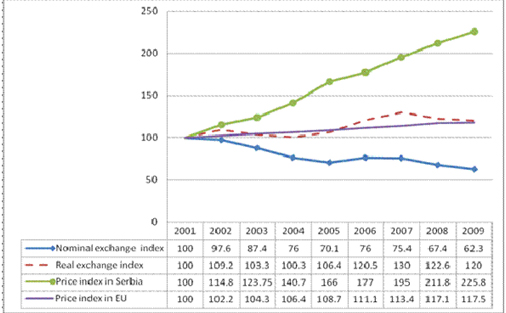

Sources: Statistical Yearbook 2001, 2002, 2003, 2004, 2005, 2006, 2007, 2008 and 2009, Statistical Office of Republic of Serbia. To be clear, since development of non-tradable sectors is complementary to development of tradable sectors, we do need investments in non-tradable sectors. It is certain that without qualitative enough roads, highways, railroads, telecommunications, financial and community services, sources of energy and residential apartments and houses, there will be no foreign direct investments. What we need is a mix of monetary, fiscal and industrial policy that will provide sufficient amount and appropriate ratio of investments in tradable and non-tradable sectors, whereas, at the same time, domestic household consumption must be, in certain proportions, reduced. Monetary policy, inflation and real exchange rate appreciation We have already argued that, apart from expansive government expenditures, monetary policy also created strong inflation pressures. Namely, announced policy goal of the National Bank of Serbia (NBS) has been inflation targeting. However, instead of controlling inflation via reducing overheated domestic aggregate demand, NBS insisted on policy of a stabile exchange rate regime, which significantly contributed to escalation of external illiquidity. Continual real appreciation of Serbian currency in the period of 2001-09 has had unfavorable effect on development of export-oriented sectors. In Graph 3, we can see that in 2008 and 2009 a real exchange rate appreciated by 20% (2001 is base year). In that way, imports became cheap and exports expensive, which further negatively influenced current account and trade balance[10] and, consequently, stock of external debt. It is to say that in order to satisfy considerable profit appetites of importers, local banks, speculators in repo market, borrowers and, eventually to satisfy its own narrow interests (achievement of inflation goals), NBS directly jeopardized interests of domestic export-oriented sectors, which supposed to be generator of sustainable economic growth. Namely, nominal appreciation of exchange rate lowers import prices expressed in the local currency (dinar). Having in mind that share of imported products in Serbian GDP have been around 45%, nominal appreciation of local currency significantly reduced inflation. Graph 3. Nominal and real exchange index of RSD vs. euro and price index in Serbia and EU

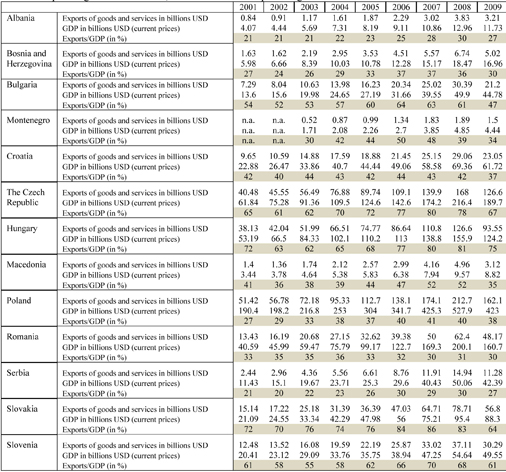

Source: Author’s calculations. Concluding remarks It is obvious that small countries with unsatisfactory share of exports in GDP that mainly use capital inflows to import consumption goods and services do not have chances to generate stable, qualitative and sustainable growth. Instead of development based on investments into non-tradable sectors, experiences of successful transition countries unambiguously refer to a quite opposite solution: massive investments into export-oriented sectors. It is not possible to optimize industrial production within small market, which is why a share of exports in GDP is a key indicator of success of small transition countries. Data in Table 7 reveal more than unsatisfactory export performances of Serbia. Table 7. Export of goods and services, GDP and share of exports of goods and services in GDP

Source: IMF, International financial statistics online and author’s calculations. What is more, overall impression becomes even worse if we include into consideration structure of exports, degree of finalization of export products, share of exports in imports, etc. It is important to notice that dominant contribution to already very low exports comes from foreign companies, which in essence perform final processing jobs (Sartid is at the same time the biggest importer and exporter). Products of a low degree of finalization have a significant share in exports. Namely, there is a complete absence of valuable and sophisticated products in Serbian exports. Plumes of domestic exports in earlier periods (heavy and military industry) are, at the moment, in midst of financial difficulties and are either inadequately or not privatized at all. Whole concept of reindustrialization has to be grounded on export capabilities. Unfortunately, our entrepreneur elite is still unaware that it is in their own interest to invest in industry and tradable sectors. Stream of huge profits created in financial sector or on the basis of foreign loans invested in wholesale and retail trade, real estate and land has dried up: expected capital gains from reselling of various assets to foreigners are absent, expected renting incomes are also absent, so that the only rational maneuver is to invest into industry in order to generate incomes abroad. Also, since industrialization demands tectonic changes in education, tax and finance policy and social values, lack of any strategic approach to development of tradable sectors at the macroeconomic level is conspicuous. Global financial crisis and volatility of the world financial and commodity markets that followed, indicate that nations of future are not the ones, which, in their development, rely on redistribution of world’s wealth and natural resources, but on creative human power. Country like Serbia, without natural recourses has to take advantage of the only scant recourse it possess – young educated people. However, as far as we can see, it seems that, contrary to sane reasoning, they are personas non grata here. What Serbian economy desperately needs is a reform of the state administration and state policy aiming at becoming a place where it is possible to produce cheaply and qualitatively, and what at the same time could be profitably sold only abroad. Such a spectacular u-turn in distribution between accumulation and consumption demands completely changed position of the Government (fiscal, monetary and developmental policy) and, instead of fiscal and current account deficit, generation of surpluses that will be directed towards investments. Still, even if we boldly accept assumption that the Serbian Government is willing to apply such painful policies, it is questionable whether it can count on necessary political support needed to conduct radical economic reforms. References European Bank for Reconstruction and Development (EBRD), http://www.ebrd.com/ European Statistics (EUROSTAT), http://epp.eurostat.ec.europa.eu/ IMF, International financial statistics online, http://www.imf.org/ Ministry of Finance, Republic of Serbia, http://www.mfin.sr.gov.yu/ National Bank of Serbia, http://www.nbs.rs/ Statistical Office of Republic of Serbia, http://webrzs.stat.gov.rs/ Radonjić, Ognjen and Kokotović, Srđan. 2010. “Seven Years of Mouth-to-Mouth Resurrection: Critical Analysis of Serbian Model of Economic Growth in Period 2001-2007” (in Serbian). In Cohabitation with reforms. Citizens of Serbia facing the challenges of 'transition' heritage, ed. Slobodan Cvejić, 37-66. Belgrade: Institute for Sociological Research, Faculty of Philosophy, Belgrade. Stamer, Manfred. 2009. “Slovak Republic - Country Review“ Euler Hermes Group, May 2009. Zec, Miodrag. 2008. “Reforms: Concept and Realization.“ (in Serbian). In Where Serbia Goes? Accomplishments and Scopes, ed. Miodrag Zec and Božidar Cerović,11-21. Belgrade: Scientific Association of Economists of Serbia and Faculty of Economics, Belgrade.

Ognjen Radonjić, Faculty of Philosophy, University of Belgrade * This study has been done within project “Social actors and social changes in Serbia in period 1990-2010” of Ministry of Science, Republic of Serbia (project no. 149005). [1] For example, the state forced enterprises to save and pay interest rate on forced savings or to apply a method of programmed accumulation, i.e. the state determined proportions between consumption and accumulation in process of income distribution. [2] GDP equals sum of household, investment and government consumption and exports minus imports of goods and services. [3] The nominal exchange rate is the rate, at which one can trade the currency of one country for the currency of another. The real exchange rate is the nominal exchange rate adjusted for relative prices among countries under consideration. [4] Immediate consequence of massive capital inflows is a sharp rise in demand for local currency. In order to prevent nominal exchange rate appreciation, central banks intervene in foreign exchange market, i.e. buy foreign currency and sell local currency, which, in the final instance, leads to rise in money supply and foreign exchange reserves. However, in order to prevent inflation due to rise in money supply, central banks often conduct process of sterilized foreign exchange operation in money markets: by selling repos, central bank withdraws currency from circulation and in such a way, leaves monetary base and money supply intact. On the other hand, high interest rate on repos issued by the National Bank of Serbia (annual interest rate on repo operations maturing in two weeks was 17,75% in 2008 and 9,5% in 2009) further attracted foreign speculative capital and, in that way, further exuberated problem of external indebtedness and continual loss in foreign exchange reserves (in the period of 2006-July 2010 NBS spent around 3 billion euros in order to defend dinar, and only in 2010 up to August half of this sum). [5] In 2009, household consumption and final consumption in Albania was 84.7% and 95.7% of GDP respectively, Bulgaria 68.2% and 86.2%, Croatia 58.2% and 77.4%, Hungary 75.3% and 85.2%, Romania 68.7% and 75.7%, Slovakia 60.3% and 79.1% and Slovenia 53.7% and 73.3%. IMF, International financial statistics online. [6] In 2009, gross capital investments in Albania were 28% of GDP, Bulgaria 28.4%, Croatia 23.5%, Hungary 19.6%, Romania 32.7%, Slovakia 26.3% and Slovenia 24.8%. Ibid. [7] In EU 15 share of agriculture, hunting and fishing and manufacturing in GVA was in 2007 1.6% and 19.7% and in 2008 1.6% and 19.6% respectively. In, for example, Slovak Republic share of agriculture, hunting and fishing and manufacturing in GVA was in 2007 3.5% and 30.9% and in 2008 3.1% and 29.7% respectively. (Eurostat). Also, share of machinery and transport equipment, intermediate manufactured products, miscellaneous manufactured goods and chemicals in total exports in Slovakia in 2008 was 88.5%. Stamer Manfred: Slovak Republic - Country Review, Euler Hermes Group, May 2009. [8] Monetary policy has been only seemingly restrictive. In essence, it has been, indirectly, expansive. Namely, as it will be shown later on in the text, monetary authorities did not even try to put under control a dynamic rise in cross-border crediting of local enterprises, which led to a sharp rise in money supply and, consequently, domestic demand. [9] Radonjić, Ognjen and Kokotović, Srđan. 2010. [10] As a consequence of high trade balance deficit, current account deficit of Serbia in 2008 was among the highest in the region and amounted to 17.7% of GDP (National Bank of Serbia). In the same year, current account deficit of Romania was 12.2% of GDP, Bulgaria 25.2%, Slovenia 6.2%, Croatia 9.4%, Albania 15.1%, Hungary 8.6% and Slovakia 6.3%. EBRD economic statistics and forcasts. |

Од истог аутора

Остали чланци у рубрици

- Playing With Fire in Ukraine

- Kosovo as a res extra commercium and the alchemy of colonization

- The Balkans XX years after NATO aggression: the case of the Republic of Srpska – past, present and future

- Из архиве - Remarks Before the Foreign Affairs Committee of the European Parliament

- Dysfunction in the Balkans - Can the Post-Yugoslav Settlement Survive?

- Serbia’s latest would-be savior is a modernizer, a strongman - or both

- Why the Ukraine Crisis Is the West’s Fault

- The Ghosts of World War I Circle over Ukraine

- Nato's action plan in Ukraine is right out of Dr Strangelove

- Why Yanukovych Said No to Europe

.jpg)

Summary: Experiences of former underdeveloped economies, as well as experiences of successful transition economies indicate that development of strong and competitive export-oriented sectors is a quintessential step in achieving the goal of sustainable economic growth. However, in contrast to the above mentioned experiences, Serbian macroeconomic policy, on one hand, completely neglects interests of export-oriented sectors and, on the other, favors dynamic development of non-tradable sectors and speculative activities. In our paper, we argue that Serbian model of development is unsustainable and harmful. Serbian economic policy needs to undergo tectonic changes as soon as possible in order to preserve what has left of remaining national wealth, and, eventually to build up export-oriented production aiming at generating sustainable fiscal and trade balance surpluses.

Summary: Experiences of former underdeveloped economies, as well as experiences of successful transition economies indicate that development of strong and competitive export-oriented sectors is a quintessential step in achieving the goal of sustainable economic growth. However, in contrast to the above mentioned experiences, Serbian macroeconomic policy, on one hand, completely neglects interests of export-oriented sectors and, on the other, favors dynamic development of non-tradable sectors and speculative activities. In our paper, we argue that Serbian model of development is unsustainable and harmful. Serbian economic policy needs to undergo tectonic changes as soon as possible in order to preserve what has left of remaining national wealth, and, eventually to build up export-oriented production aiming at generating sustainable fiscal and trade balance surpluses.