| NSPM in English | |||

The Bank of England battle |

|

|

|

| субота, 24. април 2010. | |

|

(Global Europe Anticipation Bulletin, 16.4.2010)

Just as LEAP/E2020 anticipated many months ago, and in contrast to the reports coming out of the media and the « experts » during these past few weeks, Greece really has the Eurozone behind it to give support and credibility (especially concerning good management in the future, the only guarantee of an escape from a damnable cycle of growing public deficits[1]). There will not be, then, any Greek default of payment even if the commotion over the Greek situation really is an indication of a growing awareness that money to finance the huge Western public debt is becoming increasingly difficult to find: a situation now “untenable” as a recent report of the Bank of International Settlements underlined. The fuss made over Greece by the English and US media in particular tried to hide from the majority of the economic, financial and political players the fact that the Greek problem wasn’t a sign of an upcoming Eurozone crisis[2] but, in fact, an early warning of the next big shock of the global systemic crisis, that is to say a collision between, on the one hand, the virtual British and US economies founded on untenable levels of public and private debt and, on the other hand, the double wall of borrowing, maturing from 2011 onwards, combined with a global shortage of available funds for refinancing at low rates. As we have explained since February 2006, at the time of our anticipation of its imminent arrival, one mustn’t forget that the current crisis has its origin in the collapse of the world order created after 1945, of which the United States was the support, assisted by the United Kingdom. Also, in order to understand the real effect of events caused by the crisis (the Greek case, for example), it is useful to relate their significance to the structural weaknesses which characterise the heart of the world in full meltdown: so, for our team, the “Greek finger” doesn’t cite the Eurozone as much as the explosive dangers of the exponential financing needs of the United Kingdom and the United States[3].

Subscribers should be aware that during a period when financing requirements exceed available funds, as is the case today, the sheer amount as regards sovereign debt issuance is more important than the ratios (amounts in relative value). This is shown by a very simple example: if you have 100 Euros and you have two friends, one “poor”, A, who needs 30 Euros and the other « rich », B, 200 Euros. Even if B can pledge his expensive watch, worth 1,000 Euros, to you, whilst A only has a 20 Euro watch, you can’t help B since you haven’t sufficient funds available to fulfill his financing requirements; however, in discussing a pledge and interest, you can decide to help A. Putting it in this perspective thus invalidates all the arguments based on the debt ratio: in fact, according to their logic, you would obviously help B, because his debt ratio is clearly more favourable (20%) than A’s (150%). But in the world of the crisis, where money is not available in unlimited quantities[4], the theory hits the wall of reality: wanting to do something is one thing, being able to do it is another. So then, LEAP/E2020 asks two simple questions: . who will be able/want to help the United Kingdom after the 6th May when its political chaos will inevitably expose the advanced meltdown of all its budget, economic and financial parameters? The financial situation is so serious that the technocrats running the country have devised a plan, submitted to the parties contesting the next General Election, in order to avoid risking a power vacuum which could lead to a collapse in Sterling (which is already very weak) and British treasuries (Gilts) (the Bank of England having bought 70% of those issued over the last few months): Gordon Brown would remain Prime Minister even if he loses the election, unless the Conservatives were able to garner sufficient votes for outright victory[5]. In effect, with an economic and political crisis as a backdrop, the polls lead one to think that the country is turning to a “Hung Parliament”, without a clear majority. The last time that happened, in 1974, was a kind of political preliminary to IMF intervention eighteen months later.[6] For the rest the Government puts a positive spin on the statistics to try and create the conditions for a victory (or a managed defeat). However the reality is depressing. British real estate is trapped in a depression which will prevent prices reaching their 2007 levels for many generations (in other words, never) according to Lombard Street Research.[7] The three parties are preparing to face up to a catastrophic post-electoral situation.[8] According to LEAP/E2020 the United Kingdom could well suffer a “Greek”[9] event with British leaders announcing that the country’s situation is substantially worse than that disclosed before the election. The numerous meetings, at the end of 2009, between the Chancellor of the Exchequer, Alistair Darling, and Goldman Sachs is a very reliable indicator of sovereign debt manipulation. As we wrote in the last GEAB issue, all one needs to do is follow Goldman Sachs to know where the next risk of sovereign debt payment default lies.

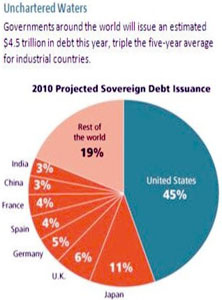

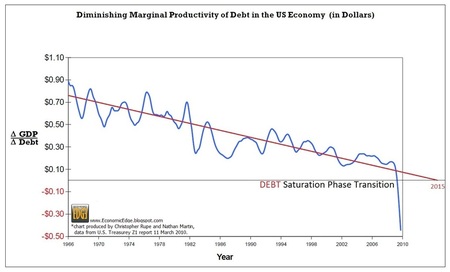

. who will be able/want to back the United States once the British fuse[11] has started burning, causing panic in the sovereign debt market in which the United States is, by far, the largest issuer? Especially since the size of sovereign debt needed corresponds with the start of the expiry, beginning this year, of a mountain of US private debt (commercial real estate and LBO due for refinancing, amounting to 4.2 trillion USD of private debt expiring in the United States between now and 2014 (averaging one trillion USD a year)[12]. Purely by chance, it is the same amount as new global sovereign debt issuance for 2010 alone, of which almost half is by the US Federal Government. Adding to that the financing needs of the other economic players (households, businesses, local authorities), the United States must find nearly 5 trillion USD in 2010 to avoid “running dry”. Our team anticipates two replies just as stark: . as regards the United Kingdom, the IMF and the EU, perhaps;[13] and we’ll be watching, from this summer, the “Bank of England battle”[14] to try and avoid a simultaneous collapse in Sterling and UK public finances. In all cases Sterling will not come out undamaged and the crisis in public finances will engender an austerity plan of unprecedented size. . as regards the United States, no one; because the size of its financing requirements exceeds the capacity of other players (including the IMF)[15] and, in winter 2010/2011, this event will lead to the explosion in the US Treasury Bond bubble founded on a huge increase in interest rates to finance sovereign debt and private debt refinancing needs, causing a new wave of financial institution bankruptcies. But it isn’t only countries that can default on payment. A Central Bank can also go bankrupt when its balance sheet consists of “ghost assets”[16] and the Fed will have to face up to a real risk of bankruptcy, as analysed in this GEAB issue. Winter 2010 will, equally, be the stage for another destabilised event in the United States: the first major elections since the beginning of the crisis[17] when millions of Americans will probably express their feelings that they have had a “belly-full” of a continuing crisis,[18] which doesn’t affect Washington and Wall Street,[19] and which creates US public debt which is now counter-productive: a borrowed Dollar now causes a loss of 40 cents (see chart below).

One may not be in agreement with the answers given by our team to the two questions asked above. However, we are convinced that these questions cannot be ignored: no analysis, no theory on world developments over the next three quarters is credible if it doesn’t provide clear replies to these two questions: “who will be able/want to?”. From our side, we think the same as Zhu Min, the Deputy Governor of the Chinese Central Bank, that “the world hasn’t enough money to buy any more US Treasury bonds”[20]. Global Europe Anticipation Bulletin - Public announcement GEAB N°44 (April 16, 2010) [1] The United Kingdom must impose this type of restrictions itself after the next General Election or certainly via direct IMF intervention; whilst the United States is unable to do the former without a major crisis affecting its public debt. [2] Not only was the fear disseminated by experts throughout the interviews given by them without foundation but, in addition, the Greek case has duly served to push the Eurozone into equipping itself with the instruments and procedures which it was missing in the field of governance. We will not even mention the clear frustration of numerous commentators and experts who dreamt of seeing Germany refuse its support and/or who made the Greek case the living proof of their economic theories on monetary zones. On this topic, the LEAP/E2020 team wants to give a reminder of its own view: economic theories, whether about monetary zones or other subjects, are as much use as horoscopes. They make no mention of reality, but say all on the thoughts of their writers and about those they “target” with their analyses. A monetary zone only exists and lasts for so long as there is a strong and lasting political will to share a common destiny, as is the Eurozone’s case. To understand, one should study history, not the economy. So, in order to avoid constantly repeating his biased babyboomer and dogmatic theories, a Nobel prizewinner for economics, like Paul Krugman, would be better studying history. That would allow the readers of the New York Times and numerous other publications which duplicate his work throughout the world to stop mistakenly focusing on the few trees which hide the forest. [3] As we have often reminded subscribers for more than a year now, it is quite clear that some Eurozone countries face substantial financing needs and, precisely, that helps to create a difficult environment for all large-scale public debt refinancing, knowing that the United States and the United Kingdom are the two “champions” in all categories of financing/refinancing needs. [4] We emphasize this fundamental fact: state bailouts of the banks then, and, from hereinon, the risk of bankruptcy of the same states, illustrate the fact that contrary to the soothing articles which populate the media, money is not available in unlimited quantities. When everyone needs it, it's the moment when one becomes aware of the fact. [6] Source: BBC / National Archives, 12/29/2005 [8] Source: The Independent, 04/06/2010 [9] The new Greek leaders announced after their election victory that the country’s budget situation was much worse than previously stated. [10] These estimates are based on official Federal Government forecasts which, according to LEAP/E2020, are way too optimistic not only as regards tax receipts (which are no longer reliable) but also as regards the costs of stimulating the US economy (which are higher). [11] In numerous GEAB issues since 2006 we have extensively recounted the structural ties between the City and Wall Street and the role of a “float” that the United Kingdom plays in relation to the US ship. On this occasion, the distrust over London’s debt will irrevocably cause mistrust over Washington’s. [12] Source: Brisbane Times, 12/15/2009 [13] Perhaps, because there isn’t any mechanism in the EU requiring financial support to be provided, especially for a country which has, for decades, refused to take on any restrictive obligation with its European partners. The “splendid isolation” can become a terrible trap when the wind changes. So, that leaves the IMF… whose coffers Gordon Brown was mysteriously keen to fill last year! [14] Contrary to the Battle of Britain (06/1940 – 10/1940), in which RAF pilots, helped by radar, prevented the Nazi invasion of the British Isles, the “pilots” of the City financial institutions, helped by the Internet, will help to aggravate the problem by fleeing to Asia or the Eurozone. [15] LEAP/E2020 pointed out at the beginning of 2009 that, after summer 2009, it would be impossible to channel the crisis. Last year, an IMF, recapitalised at 500 billion USD (following the London G20 meeting) could still have covered US financing needs. In addition to the fact that this total amount is no longer available because the IMF was obliged to pay out more than 100 billion USD in aid to the countries most affected by the crisis, this year making available a similar sum would only represent 10% of the US’ short term requirements; in other works a drop in the ocean. [16] As demonstrated by the information eventually supplied by the Fed on the condition of its balance sheet. Sources: Huffington Post, 03/22/2010; Le Monde, 06/04/2010 [17] The 2008 Presidential election had been synchronous with the perception of the beginning of a crisis. In November 2010, electors will express their views after two full years of crisis. A big difference. [18] Different to Wall Street’s and Washington’s utterances, the crisis is still here and US small businesses are more and more pessimistic. A very useful detail for understanding US statistics: they generally don’t take small businesses into account in assembling their various numbers. When one knows that, in the United States as well, small businesses constitute the bedrock of the economy, that puts the value of these statistics (even if not falsified) into perspective. Source: MarketWatch, 04/13/2010 [19] To evaluate the size of the US socio-political problem, it isn’t as much the relationship in the Democrat/Republican struggle that will be interesting to follow, but the progress made by extremists at the heart of, and the unfolding of events outside of, the two parties. [20] Source: Shanghai Daily, 12/18/2009

|

Од истог аутора

- First half of 2012: Decimation of the Western banks

- The three US crises: Budget, T-Bonds and Dollar

- Get Ready for the Meltdown of the US Treasury Bond Market

- Major Monetary Oil Shock Predicted for late 2011

- 2011 - The ruthless year, at the crossroads of three roads of global chaos

- Second half of 2011 - Explosion of the Western public debt bubble

- Financial Crisis and Global Geopolitical Dislocation

- Spring 2011 - Towards a Serious Breakdown of the World Economic System

- World Economic Crisis and Global Geopolitical Dislocation

- The “Eurozone Coup d’Etat”

Остали чланци у рубрици

- Playing With Fire in Ukraine

- Kosovo as a res extra commercium and the alchemy of colonization

- The Balkans XX years after NATO aggression: the case of the Republic of Srpska – past, present and future

- Из архиве - Remarks Before the Foreign Affairs Committee of the European Parliament

- Dysfunction in the Balkans - Can the Post-Yugoslav Settlement Survive?

- Serbia’s latest would-be savior is a modernizer, a strongman - or both

- Why the Ukraine Crisis Is the West’s Fault

- The Ghosts of World War I Circle over Ukraine

- Nato's action plan in Ukraine is right out of Dr Strangelove

- Why Yanukovych Said No to Europe

.jpg)

Europe's Sovereign Debt Crisis: Further collapse of Britain's pound sterling?

Europe's Sovereign Debt Crisis: Further collapse of Britain's pound sterling?